6. Taxes

Just like on your salary, you have to pay taxes on investments. Generally speaking, all types of income are taxed, also known as Income Taxes.

Denmark has a progressive tax system, which means that the higher the income, the higher the tax rate, i.e. more tax must be paid on the last DKK earned compared to the first DKK earned, after certain thresholds are reached. You have probably heard about the "Top-skat", meaning you pay 3% more taxes on the yearly income that surpasses 640.109 DKK.

The income you're most familiar with, e.g. your salary, pension or bonuses, is called "Personal income" (DK: Personlig indkomst).

SKAT's positivlist

The Danish tax authority SKAT has a compilation of specific Funds that meet certain special requirements, are therefore taxed in a different category and thus can have lower tax rates. This list is known as SKAT's "PositivList" (Eng: Positive list).

Income generated from investments is generally referred to as Capital Income (DK: Kapitalindkomst).

However, Denmark actually categorizes this into three income types:

- Aktieindkomst (Eng: Stock Income): Income generated from these investments is taxed at a progressive rate. Profit, up to 67.500 DKK (in 2025) is taxed at 27% - thereafter, you will be taxed at 42%. Married couples can combine the total of their upper limit, resulting in a limit of 135.000 (in 2025) before being taxed at 42%. "Aktieindkomst" includes the following products:

- Profits from the sale of stocks (capital gains)

- Dividends received from stocks

- Investments in ETFs, mutual funds, and Danish funds listed on SKAT's positive list

- Kapitalindkomst (Eng: Capital Income): All other investment income (e.g. interests generated from saving accounts) or securities not on SKAT's positive list, are taxed as "Kapitalindkomst". Here, the total net amount of all of them is what you are taxed on. For example, if you've received +5.000 DKK interest from a savings account (Dk: Opsparingskonto), but had to pay -1.000 DKK in interest for a bank loan, then you only pay taxes on 4.000 DKK. The applicable tax rates for 2025 are as follows:

- Positive net capital income up to 52.400 DKK is taxed at 37% - thereafter, you will be taxed at 42%

- If your net capital income is negative, you can use it to reduce your municipal and church taxes. You can deduct 33% of the negative amount up to 50.000 DKK, and any amount above that can be deducted at a lower rate of 25%

- Aktiesparekonto (Eng: Stock savings account): Sometimes referred to as ASK, this is a type of investment account available in Denmark. It allows you to invest up to 166.200 DKK (in 2025) in Stocks, Mutual Funds, Danish Investment Funds and ETF’s that are on SKAT’s positive list with a preferential taxation of only 17%. You’re only allowed to have one Aktiesparekonto with any bank.

When do you pay taxes?

There are two options for when the tax is due:

- Realisationsprincippet (Eng: taxed when realized): You pay tax when you realize a return, which means when you sell a Security or receive a dividend. All Stocks and dividend-paying Funds (Mutual and Danish Investment Funds, not ETFs) are taxed using the "Realisationsprincippet".

- Lagerprincippet (Eng: Inventory-taxed): Tax is paid on investments annually, regardless of whether they are sold. At the end of each year, the increase or decrease in the value of investments is calculated. If the return is positive, tax is paid. If the return is negative, a deduction is received which can be offset against any profit next year. All ETFs, accumulating Funds, Bond-based Funds or assets on an Aktiesparekonto are taxed following the "Lagerprincippet".

Deducting Losses

If you lose money on your investments, you may be able to reduce your taxes by offsetting those losses against your other gains. The rules for deducting losses vary:

- Kapitalindkomst (Capital Income): If your total Kapitalindkomst is negative, it can be deducted from your municipal and church taxes, For the first 50.000 DKK you lose, you can reduce your local and church taxes by 33% of that amount. If you lose more than 50.000 DKK, you can reduce your taxes by 25% of the extra amount. Negative Kapitalindkomst will show up on your annual tax report (Årsopgørelsen) as "Nedslag for negativ kapitalindkomst".

- Aktieindkomst: This includes income from Stocks, ETF's and Danish Investment Funds. The tax treatment depends on the asset type:

- Stocks and Danish Investment Funds: These are taxed as Aktieindkomst. If you incur losses on these, you can offset them against other Aktieindkomst gains. If your losses exceed your gains, the remaining losses can be carried forward indefinitely to offset future profits. (Source)

- ETFs (on SKAT's positivliste): These are also taxed as Aktieindkomst. Losses from these ETFs can be used to offset other Aktieindkomst gains in the same year. Any unused losses are offset against your municipal and church taxes, like Kapitalindkomst. These losses will appear in your annual tax statement (Årsopgørelse) as "Negativ aktieskat". If the losses are large enough to create a negative amount in your municipal and church tax of the current year, the extra amount can be carried forward to reduce next year’s municipal and church tax. Keep in mind that ETFs not listed on SKAT’s positivliste are taxed as Kapitalindkomst (Source). (Source)

- Aktiesparekonto (Stock Savings Account): Losses incurred within an Aktiesparekonto can only be used to offset other Aktiesparekonto gains and can be . They cannot be used to reduce other Aktieindkomst or Kapitalindkomst.

Example 1: How Loss Deduction Works in an Aktiesparekonto

Let’s say you invested in two ETFs on an Aktiesparekonto. Remember that an Aktiesparekonto is inventory-taxed (Dk:Lageprincippet) at 17%. Tax is paid on investments annually, regardless of whether they are sold or not. At the end of each year, the increase or decrease in the value of investments is calculated.

- 2021:

- "ETF A" loses 5.000 DKK.

- "ETF B" gains 2.000 DKK.

- So, your total loss for 2021 is 2.000 DKK - 5.000 DKK = -3.000 DKK (you lost 3.000 DKK).

- This 3.000 DKK loss is carried forward to the next year.

- 2022:

- "ETF A" and "ETF B" each gain 1.000 DKK.

- After combining your gains and subtracting last year’s loss, your total is 1.000 DKK + 1.000 DKK - 3.000 DKK = -1.000 DKK.

- You’re still at a loss, so you don’t pay any tax. The remaining -1.000 DKK is carried forward to the next year.

- 2023:

- "ETF A" and "ETF B" each gain 2.000 DKK.

- After adding your gains and subtracting your loss, your total is 2.000 DKK + 2.000 DKK - 1.000 DKK = 3.000 DKK.

- Now you’ll need to pay 17% tax on those 3.000 DKK, which is 510 DKK.

Example 2: Deducting Losses from Kapitalindkomst

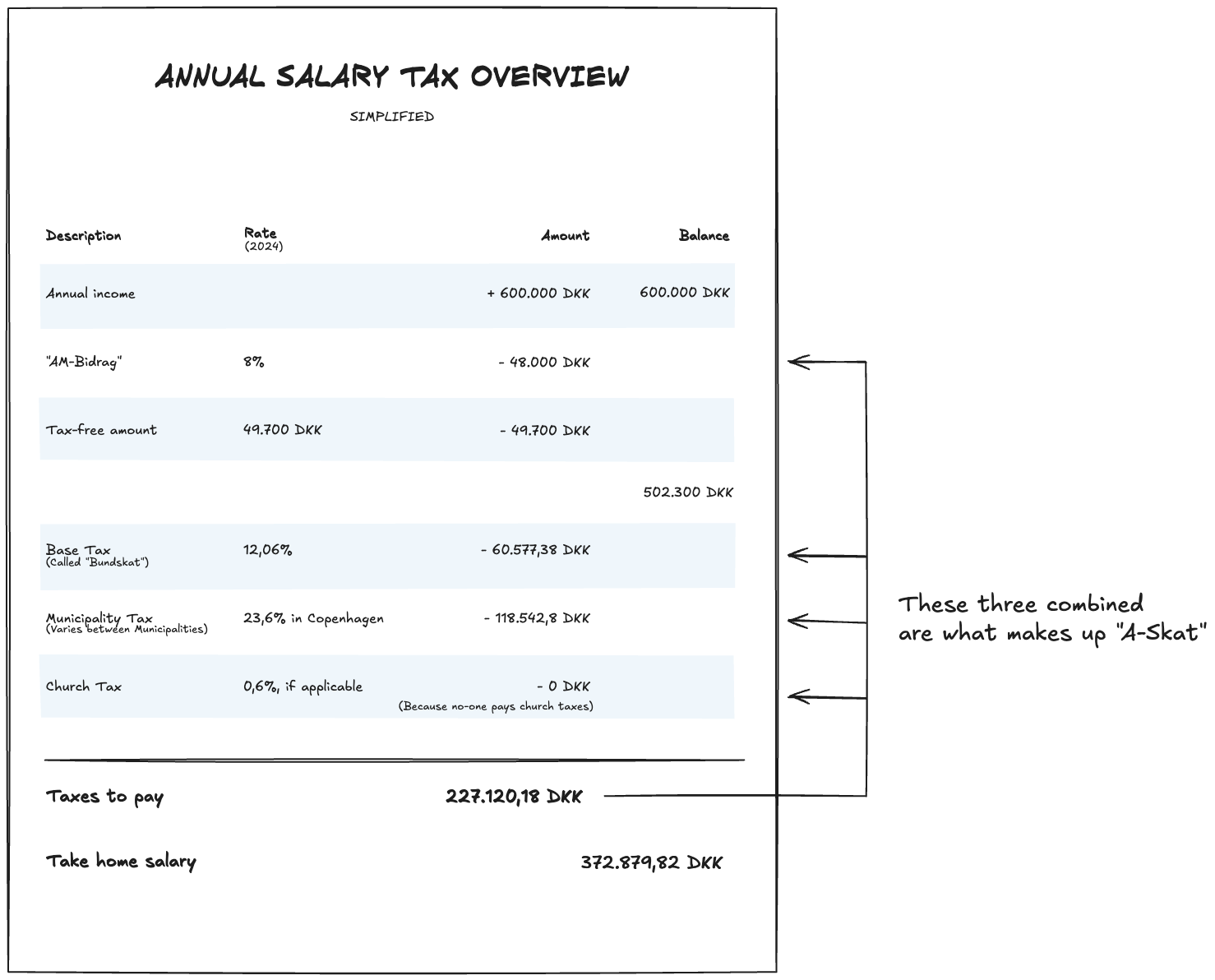

Let’s say you have a yearly salary of 600.000 DKK.

Normally, you would pay about 227.120 DKK in taxes. Here’s a simplified tax calculation to show how it works:

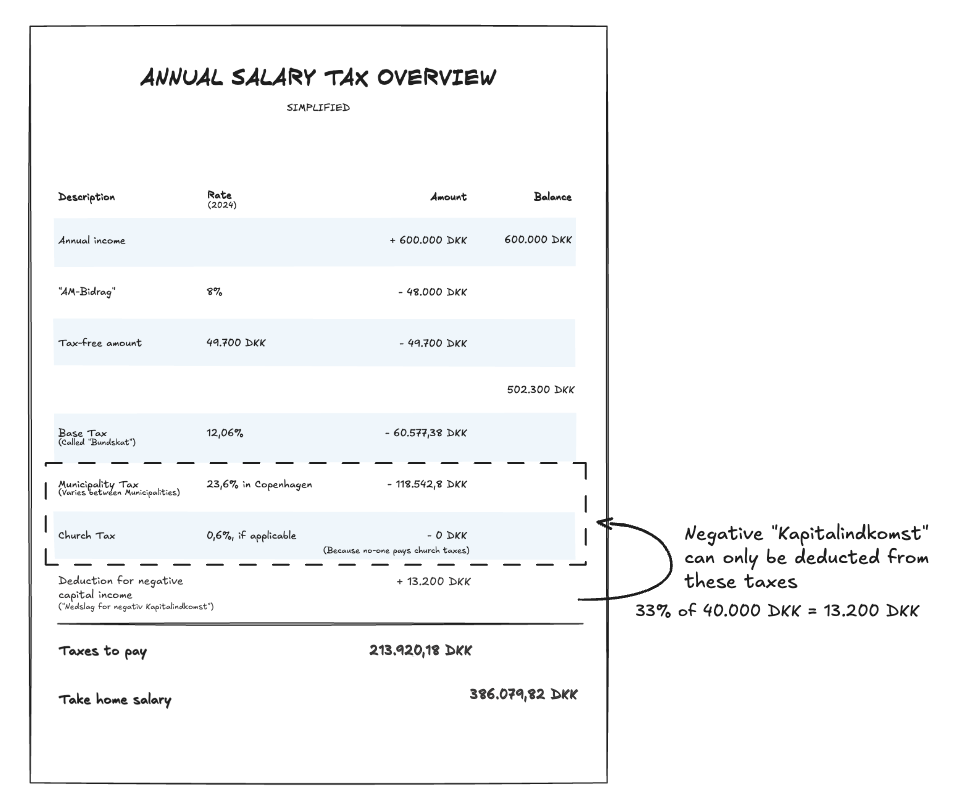

You also have invested in two ETFs that are not on SKAT's positivliste, which then are inventory-taxed (Dk: Lagerbeskatning) as Kapitalindkomst (37%/ 42%). Now imagine that in the same year:

- "ETF C" lost 60.000 DKK, and

- "ETF D" gained 20.000 DKK in value.

In total, your net Kapitalindkomst (investment income) is 20.000 DKK - 60.000 DKK = -40.000 DKK (an 40.000 DKK loss).

You can use these -40.000 DKK loss to reduce your municipal and church taxes, as shown in the image below.

How do you pay taxes?

When you invest in an Aktiesparekonto, taxes are taken care of automatically. Whenever you make money from your investments, taxes are deducted from your account. If you don't have enough cash to cover the taxes, the bank or platform may sell some of your investments or allow your account to go into negative balance to pay the taxes. You'll be notified if this happens and given time (usually 30 days) to add more cash to cover the shortfall. Even if you've already reached the accounts limit of 135.900 DKK (160.000 DKK starting in 2025), you can still add extra cash to cover taxes owed. SAXO is one example where you'll go into a negative balance and add cash to cover for taxes.

Dividend taxes are paid automatically upfront. When you receive dividends, 27% (or more) of the amount is withheld by SKAT before the rest 63% (or less) of your dividend is refunded to your account.

All non-Aktiesparekonto investments are automatically reported to SKAT if you use a Danish bank or investment platform (SAXO or Nordnet). Taxes are then generally paid to Skat in connection with the publication of your "Årsopgørelse" (ENG: Annual tax statement) during the month of March.

You can also choose to pay taxes to SKAT before the end of the year. Some investors pay a 42% tax upfront on any profit from investments, just to not be bothered by figuring out the tax amount. Worst case, you've already covered the taxes what you owe, the best case, you get money back in March if you paid too much in taxes!

Tax Flowchart

Sources: 1, 2, 3, 4, 5, 6, 7, 8, 9

Double taxation on dividends on foreign Stocks & Funds

Investing in foreign Stocks or Funds that offer dividends may lead to double taxation, meaning taxation occurs both in the country where the Stock or Fund is registered and in your home country, Denmark in this instance. Each country has its own rules governing dividend taxation, making it crucial to understand the specific regulations of the country where the shares are registered.

Registration country vs. traded country

Stocks or Funds can be registered in one country, but sold in another one. For example, Apple Stocks can be sold on four stock exchange markets: NASDAQ USA, XETRA Germany, XSWX Switzerland and XMIL Italy even though they are registered only in the USA. Don't assume a stock is registered where it's traded.

Upon receiving dividends from foreign shares, you will automatically pay a tax percentage to the foreign tax authority of the registration country. If there exists a double taxation agreement, referred to as dobbeltbeskatningsoverenskomster (DBO, also sometimes known as "dobbeltbeskatningsaftalerne"), between the country in question and Denmark, the dividend is taxed at a maximum of 15% in the registration country, with the remaining taxation (27% - 15% = 13%) conducted by SKAT in Denmark. However, this does not imply that only 15% tax is deducted.

In some cases, countries like Germany deduct automatically 26.375%. In such instances, you are then required to reclaim those taxes with e.g. an online form, a process that can be overly complicated.

Hence, it is vital to consider dividend-paying Stocks or Funds from certain countries over others. Here are some examples:

| Country | Tax | DBO | Refundable |

|---|---|---|---|

| Australia | 30% | Yes | Yes |

| Canada | 25% (Nordnet automatically reclaims 10%, leaving you to pay 15%) | Yes | Yes, but not necessary with Nordnet |

| Netherlands | 15% | Yes | Not required since capped at 15% |

| Italy | 26% | Yes | Yes |

| Ireland | Stocks: 25% ETFs: 0% | Yes | Yes Not required |

| Switzerland | 35% | Yes | Yes |

| United Kingdom | 0% | Yes | Not applicable |

| Germany | 26.375% | Yes | Yes |

| United States | 15% | Yes | Not required since capped at 15% |

| South Korea | 22% | Yes | Yes |

| Sweden | 30% (Nordnet & Saxo automatically reclaim 15%, leaving you to pay 15%) | Yes | Yes, but not necessary with Saxo or Nordnet |

| Luxembourg | 15% | Yes | Not required since capped at 15% |

The 0% dividend tax in Ireland is a significant reason why numerous ETFs are registered there, including the iShares Core S&P 500 UCITS (SXR8), traded on multiple stock exchanges such as XETRA Germany and XSWX Switzerland.